Introduction

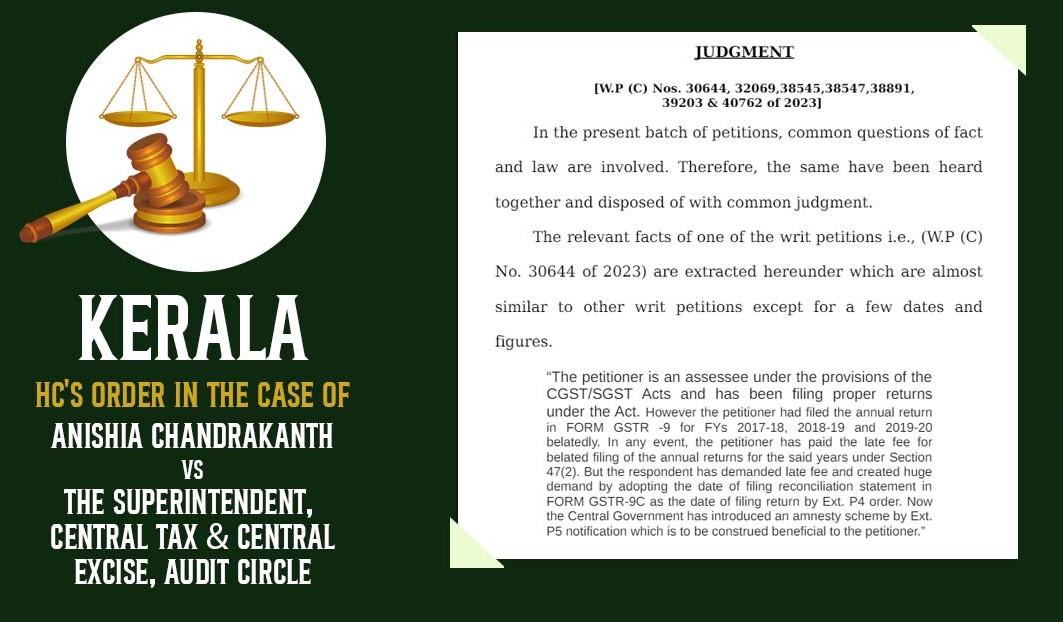

The Kerala High Court recently made a big decision regarding late fees for delayed filing of GSTR 9C under the Central Goods and Service Tax (CGST) rules. This decision is important for taxpayers as it clarifies certain aspects of GST compliance.

– The ruling addresses the exemption provided in Central Goods and Service Tax (CGST) notifications and the implications for taxpayers.

Case Overview

- Petitioner: Anishia Chandrakanth, a proprietorship concern dealer under the CGST/SGST Act, 2017.

- Business Activities: Trading of paint, cement, aluminium sheet hardware, and others.

- Compliance History: Regular filing of tax returns but occasional delays in filing within stipulated timelines.

- Legal Framework: Section 44(1) read with Rule 80 of the CGST/SGST Act mandates filing of annual return Form GSTR-9 by December 31 following the financial year.

- Government Interventions: Extensions granted for filing returns due to challenges such as Rule 80 of the GST Rules, 2017, and the COVID-19 pandemic.

Notice and Proceedings

- Show Cause Notice (SCN): Issued to the applicant on 29.03.2023 to assess late filing of yearly returns.

- Demand: Late fee of Rs. 2,93,600 imposed under Section 47(2) of the CGST/SGST Act.

- Objections: Responded by the applicant challenging the imposition of late fee.

- Corrigendum: Issued on 13.04.2023, correcting the referenced section in the SCN.

- Applicant’s Response: Detailed objections submitted on 25.04.2023.

Legal Interpretation

– GSTR-9 vs. GSTR-9C: GSTR-9 is the annual return, while GSTR-9C is a reconciliation statement, not considered a return under Section 44 of the CGST/SGST Act.

– Late Fee Applicability: Late fee applies to late filing of GSTR-9, not GSTR-9C.

– Court’s Observation: Not justified to demand late fee for GSTR-9C filings given government exemptions.

Amnesty Scheme

– Government Notification: No.7/2023-CT and No.25/2023 provided an Amnesty Scheme for non-filers of GSTR-9 returns.

– Exemption: Late fees exceeding Rs.10,000 exempted under the Amnesty Scheme for specified fiscal years.

Court Decision

– Ruling: Demand for late fee for belated GSTR 9C filings deemed invalid.

– Refund Limitation: Applicants not eligible for a refund of late fees exceeding Rs. 10,000 previously paid.

Conclusion

The Kerala High Court’s ruling brings clarity to the imposition of late fees for GSTR 9C filings, aligning with government notifications and exemptions.

Taxpayers should adhere to compliance deadlines and understand the legal nuances to avoid unnecessary penalties.

For more information kindly refer to the attached order copy.

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.